Modifier Update

Navigate:  Personal Property Appraisal > Batch Processes > Modifier Update

Personal Property Appraisal > Batch Processes > Modifier Update

Description

Apply modifiers to accounts, for example, a Failure to File Penalty to accounts that have not been filed by the time Valuation Notices are generated and mailed. Modifiers can be applied en masse to a group of accounts.

NOTES:

-

In certain jurisdictions if a property owner has many PPA accounts and the total appraised value of those accounts is equal to or less than a defined amount, all accounts are 100% exempt. The ability to exempt the value of all accounts for legal parties with the same identifier value (such as SSN, FEIN) if the total appraised value of those accounts is less than or equal to a specified minimum is available using the Modifier Update Options.

-

Certain jurisdictions can exempt the value of all personal property accounts in a Revenue Account if the total appraised value of those accounts is less than or equal to a specified minimum.

-

After using the Batch Modifier Update to define the modifier(s) to add or remove, select the group of accounts to process using the standard Batch Account Selection screen.

-

The output of this process is a Confirmation Detail Report, which identifies the accounts to which the modifier was added or removed. The output also includes a PIN List of those PINs updated by this process. This is necessary to use for the subsequent task, Batch Valuation.

-

For those accounts that qualify for the exemption, an account-level modifier shall be added to the account. If the task is run to remove the modifier, then the output will be the account-level modifier shall be removed from the account.Use theAdvanced Search screen to identify all Personal Property Appraisal accounts that have a particular modifier in a given tax year. When the account is valued and/or posted, AA will calculate the modifier amount. PPA will display and store the amount AA calculates

-

You can define by LP identifier, including SSN, FEIN, or LP Group. The modifier is added to each account if the total appraised is less than or equal to the application setting value defined (Configuration > Application Settings > Maintain Applications Settings > Setting type of Effective Date and Filter by module of Personal Property > Click Edit on the 'Exemption - Other personal property exemption value' application setting to define). The modifier is removed from each account if the total appraised is no longer at or below the minimum exemption value defined.

-

Also, the modifier is not rolled when the account is rolled. When searching using Personal Property PIN List from Update Modifier for Selected Accounts screen and defining the PINS separated by a comma and hard carriage Return on the keyboard, The PIN List can be copied and pasted into the Search PIN List screen for Batch Valuation (Personal Property Appraisal > Batch Processes > Batch Valuation > Process Batch Valuation > Personal Property PIN List Selection Criteria > Search PIN List) to apply the valuation en masse. In addition, the Confirmation Detail report indicates the accounts (by PIN) that received the exemption and the accounts that had the exemption removed.

SETUP: See Personal Property Appraisal, Personal Property Appraisal Setup, and Batch Processes for any applicable prerequisites, dependencies and setup information for this task.

Steps

-

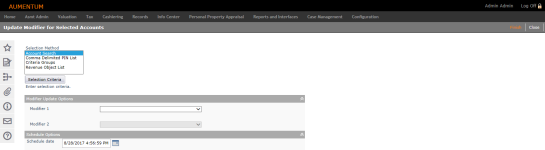

On the Update Modifier for Selected Accounts screen, make a selection from the Selection Method list and click Selection Criteria.

- Account Search – Opens the Select Accounts for Valuation screen.

- Comma Delimited PIN List – Opens the Search PIN List screen.

- Criteria Groups – Opens the Search Criteria Group List screen.

- Revenue Object List – Opens the Select Revenue Object List screen.

-

In the Modifier Update Options panel, make a selection from the Modifier 1 and Modifier 2 drop-down lists.

NOTE: Additional fields display depending on the modifier you select.-

Define any additional required data.

-

If you select the Minimum Value per Account Modifier, also define whether to add or remove the modifier, select the Legal party identifier, define the Exemption percentage and Modifier Date and select the cycle status.

-

If you select Late Filing Penalty, you can also define the Amount/Percent, docket number, effective date, expiration date, status, set cycle status.

-

Certain selections also include an Overwrite existing modifier if one exists checkbox, which when selected overwrites any existing modifiers for the selected accounts.

-

Certain selections include an Account Grouping selection. This is for jurisdictions with the requirement to exempt the value of all personal property accounts in a Revenue Account if the total appraised value of those accounts is less than or equal to a specified minimum. In this situation, If Legal Party Identifier is selected for Account Grouping, an additional drop-down list is available to select the group.

-

-

Enter a Schedule date or accept the current date default.

-

Click Finish.

-

Click Close to end the task.

Enter the applicable information on each screen, scroll to the bottom, and click Row Count to get a count of records. Click Previous to return to the Process Statutory Valuation screen.

NOTE: When the Comma Delimited PIN List Modifier Update process is run and no PINs match the selected criteria, the Confirmation Detail Report displays a message identifying why the records were skipped (e.g., "Skipped - Did not meet criteria").

Common Actions

Error Log – Opens the View Error Log screen, which shows a list of errors associated with the current action, if any.